Millions upon millions of parcels flow into Australia every month. Some dodgy operators avoid paying GST on imports by understating the value of the goods being posted. This is a huge disadvantage to our Aussie shops and we need to be doing more to enforce the rules on GST for foreign imports.

Transcript

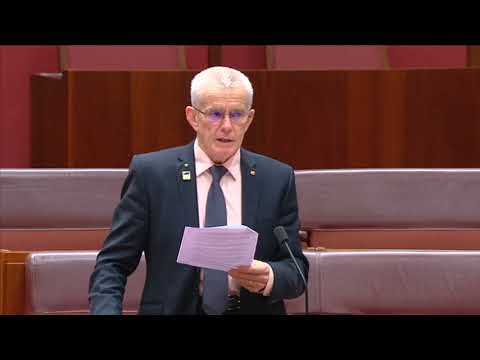

[Malcolm Roberts] I have some brief questions on border force. How many parcels come through Australian border force each financial year?

So Senator just give me one second. I’ll just get, I might just ask deputy commissioner Saunders to join me at the, the front table as well. In terms of parcels, probably I might describe it slightly differently if I could. So air cargo consignments, if I could start there cause Senator the goods coming into Australia, primarily from a border screening point of view is either sea cargo, stuff that comes in containers, air cargo, stuff that comes in crates in the belly of aeroplanes and international mail. So in terms of air cargo consignments between the 1st of July, 2020 and the 31st of March, 2021 there were 54,340,909 consignments in relation to sea cargo, there’s been a significant uptake. So I’ll give you the numbers for 19 and 20 first of all. So between the 1st of July, 2019, 31st of March, 2020 there were 2,472,286 consignments. Between the 1st of July, 2020 31st of March, 2021, 7,449,539 consignments. The reason for that is because of COVID-19 because of changes in logistics, supply chains, etc, a lot of people shopping from home, smaller consignments and the the freight forwarders need to get it here somehow. And there just isn’t a number of aeroplanes coming to Australia to support all of that coming through air cargo. So a lot of, a lot of the smaller consignments are now coming in containers and that’s led to a significant increase. In terms of international mail you see that data is actually commercially confidential because obviously Australia posts are in competition with you know, freight forwarders and other sort of international supply chain sort of companies. And, we don’t put those numbers out there Senator in terms of Australian international mail.

[Malcolm Roberts] Okay. But the total number of consignments for the nine months, July 20 to March 21 was 54 million, including air, mail and sea.

Well not including mail, I can’t give you that number because that’s commercially sensitive because Australian posts are sort of a, you know there’s a single commercial entity and they’re in competition with other people in the market. We don’t put that number out there. So what I’ve given you is in terms, sorry, air cargo consignments 54,340,909

[Malcolm Roberts] That’s just for air.

That’s for air, cargo. And for sea cargo an additional almost seven and a half million, 7.449 million.

[Malcolm Roberts] Okay. Thank you very much for that. How many of these parcels are checked for value and whether or not GST is applied?

I might just call

[Malcolm Roberts] Sorry commissioner, just on that number, the sea cargo is that, how are you quantifying that number?

Consignment, so a consignment is obviously

[Malcolm Roberts] Do you define that as per container or how

No consignment is if you import a good into Australia, that’s a consignment, so that could be an entire container load that you have or if you’ve got lots of lines of goods in a container, so let’s say a freight forwarding company wants to get a lot of consignments to Australia, previously they might put them in a crate in the belly of an aeroplane, whereas now they’re putting them in containers. So we’re getting containers with lots and lots of consignments in them.

[Malcolm Roberts] I see, thanks for clarifying.

Does that make sense?

So it’s an individual entry for an importer of a good and that can be a private person or a commercial entity.

[Malcolm Roberts] Thank you. Thanks.

Thanks Senator Roberts. I might just ask Vanessa Holben here in terms of the, the GST question. If I could, it goes to matters of customs policy.

Vanessa Holburn group manager, customs group, Australian Border force. So your question is related to GST?

[Malcolm Roberts] Yeah. How many of the parcels that come in, consignments, are checked for value and have GST applied?

So I’ll need to take on notice the number of consignments that are checked. What I can give you though, is the dollar value of the undetected, undecided GST detected?

[Malcolm Roberts] The under?

The undecided GST detected. So that’s, that’s where they haven’t obviously claimed GST. So the dollar value, would you like it in the financial years?

[Malcolm Roberts] Yes, please.

So 2019-20, 25,827,753. I can go previous years if you’d like to as well.

[Malcolm Roberts] No it’s fine.

Year to date, so 31st of March, 2021, 411,719.

[Malcolm Roberts] So that’s the, could you say that again? What is that 25 million?

So we determine it, we determine it as understated, GST detected.

[Malcolm Roberts] Understated, GST detected.

Correct.

[Malcolm Roberts] So what does that mean? Understated? So that means only the only the parcels that have been where the GST has been understated and where it’s detected.

Correct.

[Malcolm Roberts] So what proportion of parcels are waved through without checking to see if GST should be paid.

That’s what I need to check on notice for you.

[Malcolm Roberts] Okay. Thank you. Is there any estimation of how much GST has not been paid per year? It’s a massive task as, as Mr. Adam just told us.

Again, I’ll need to check that on notice.

[Malcolm Roberts] Thank you. How many notices are sent out to call in GST prior to the parcel being released?

I’ll need to check that on notice Senator.

[Malcolm Roberts] What is the estimated loss to Australia per year for the lost or forgone GST?

I’ll need to take that on notice

And senator, we’ll take that on notice, but also we do obviously with GST, recognise other departments have a stake in the GST question, the ATO and treasury. So we will take it on notice, but we’ll, we’ll also link in with our other departments who have an interest in the GST policy.

[Malcolm Roberts] Thank you. What has been done to assist the cost of this forfeit and to implement a remedy. We’ve got to define the problem before we can solve it. With 54 million consignments, I’m sorry, 61 million consignment, it’s a pretty massive opportunity.

Can you repeat the question again Senator?

[Malcolm Roberts] What’s been done to assess the, the loss of revenue the forgone revenue, and to implement a remedy.

We can talk about our audit inspection control programme.

So, so the compliance, we have a compliance programme obviously to detect non-compliance through those avenues.

[Malcolm Roberts] That’s sampling is it?

Correct, yes so there’s targets and there’s profiling. Also we do business engagements, that’s around educating those that are importing to ensure that they are quickly classifying the goods and obviously paying those duties attached to those goods.

[Malcolm Roberts] So there’d be hidden costs, is the government, I don’t know who to ask this question of, perhaps a minister, perhaps Mr. Adam, is the government aware of the hidden cost to Australian manufacturers and retailers who must add GST to their goods, whereas imports bypassing customs do not?

Probably a matter of policy I suggest, and maybe a different department would be best placed to answer that.

I’ll say, we are aware in the general sense of the matters you raise, but I’d need to take on notice the quantum of that.

[Malcolm Roberts] Yeah, so depends on the size of the problem, I understand that. So is it possible to consider another solution being tax reform? Another way of levying the tax?

Those options are always available to be considered by policymakers.

[Malcolm Roberts] Okay, Thank you very much.