The new Governor of the Reserve Bank is not ruling out raising the cash rate again to further control inflation. She refers to these measures as part of a tightening phase.

The Reserve Bank is unwinding the massive expansionary monetary policy it took during the COVID response which created $500 billion out of thin air. Meanwhile the States and the Federal ALP are spending money like it is play money.

This spending acts against the Reserve Bank’s rate rises. This is why I say this Government is hitting the brake and the accelerator at the same time.

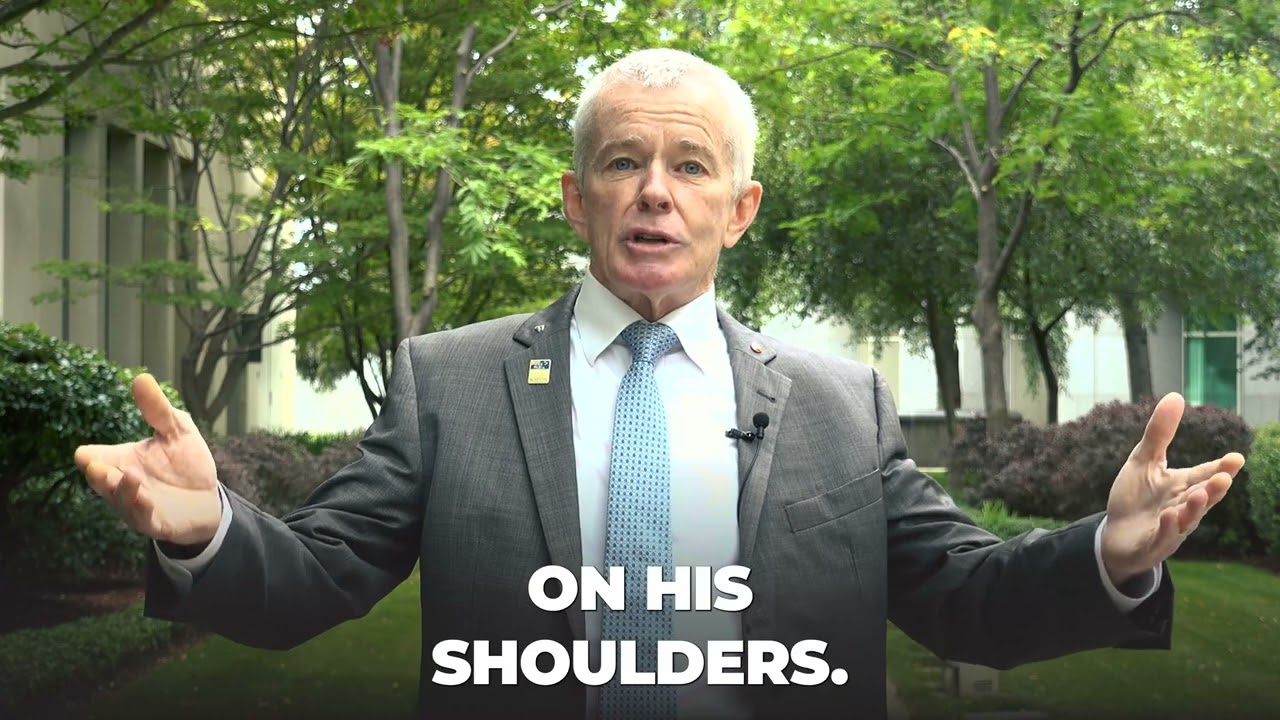

The high rate of immigration is expanding the economy and that also acts against the dampening effect of rate rises. The pain and stress of mortgage rate hikes can be attributed to the costly COVID response and to immigration. That is all on Prime Minister Albanese and Treasurer Chalmers.

One Nation will reduce immigration to reduce rents and take the heat of the property market, removing the need for further rate rises.

Transcript

Senator ROBERTS: Congratulations on your appointment.

Ms Bullock: Thank you, Senator.

Senator ROBERTS: How does it feel being in a highly complex job which is affecting so many people’s lives and livelihoods?

Ms Bullock: I do feel a great deal of responsibility, Senator.

Senator ROBERTS: Thank you. Inflation has gone from 7.8 per cent, peak, to 5.4 per cent. In your speech yesterday you went on record to say the Reserve Bank will not hesitate to raise rates again if it looks like inflation is not coming under control. Is inflation coming under control? I’m guessing from your comments so far that you’re wary and there are signs that it’s not.

Ms Bullock: I’d say what I said earlier, which is that we got an important piece of information yesterday. We need to take that away, analyse it and figure out what it means for our forecast going forward. That’s no different to the comment we’ve been making to date, which is that we are—’wary’ is a good word. We’re looking at some of the more persistent parts of inflation and asking ourselves: are there signs that those might be coming down in the future? So, yes, we are wary. We don’t know if the job is done yet, and we’ve made that very clear. Even though we haven’t raised interest rates since our last interest rate rise in June, we’ve made it very clear that we might need to go again. We had not ruled that out, and we’re in the same position now.

Senator ROBERTS: When debating the need for a rate rise, is the effect on mortgage affordability, especially mortgage stress, taken into account? If so, what measure do you use, and what is that measure telling you about how hard life is getting for mortgagees?

Ms Bullock: We do understand that there is a distribution—let me step back for one moment. Higher interest rates and monetary policy work through a number of channels. The one that gets the most attention is what we call the cash flow channel, which is the impact on people who have debt. That gets a lot of attention, particularly in Australia, because, as Chris already mentioned, most of the debt of households and businesses is variable rate debt or very short fixed-rate debt. That’s why that channel gets the most attention, but there are other channels. In fact, Chris gave a speech on that fairly recently. One is the intertemporal channel, which basically means: as interest rates go up, people are incentivised to save rather than to spend, and in fact we are observing that. We are still seeing people in aggregate save, and there’s an incentive even for mortgage holders to save. Their interest rates have gone up, so, for them, there’s an incentive now to try and put even more away into their offset and redraw accounts if they can. That’s the other way that it works. Another channel is the exchange rate channel. The way that works is: as interest rates rise, the exchange rate—if everyone else wasn’t raising their interest rates the exchange rate would rise, but at the moment it means that it hasn’t fallen very much. It has been reasonably stable over the last year. We’re not getting inflation through that particular channel. There are other channels as well.

Senator ROBERTS: Do you measure the stress?

Ms Bullock: No. We can’t very precisely say: particular channels contribute X to inflation. We can’t do it that way. But they’re all the channels that we’re watching and trying to understand how they might impact.

Senator ROBERTS: How do you assess whether or not people are under mortgage stress? Ms Bullock: We don’t do individual mortgage stress assessments. What we can observe is data we get from the banks on hardship calls that they’ve got, arrears rates and those sorts of things. We can observe those at aggregate level. The feedback we’re getting at the moment, from the banks and from the data we see, is that that has risen but it’s still at very low levels.

CHAIR: Last question.

Senator ROBERTS: Surely the inflation that’s still hitting Australians has something to do with the Reserve Bank creating $500 billion out of thin air—or, as Dr Debelle said, electronic journal entries—over COVID. Have you thought about that? Your predecessor admitted it was a cause of the inflation problem, creating that $500 billion out of thin air.

Ms Bullock: Basically, you’re referring to the massive expansionary monetary policy that we undertook during the pandemic?

Senator ROBERTS: Yes.

Ms Bullock: I think my response would be that, at the time, we were facing a very, very dire economic situation, and the appropriate response at the time was to run a very expansionary monetary policy. We have now unwound that and we’re in a tightening phase, so, yes, the purpose of the expansionary monetary policy was in fact to encourage demand and encourage growth. That was very much the intention. To the extent that we look back and now say, ‘Well, demand is too strong,’ we are now in a tightening phase to wind that back. But I wouldn’t say it was the sole reason for the increase in inflation. You might remember that there were very big supply chain issues as well, and when constrained supply meets high demand, you get inflation.

Senator ROBERTS: Building on that, you have a very blunt tool to attack inflation, don’t you? Because the cash rate for the entire country is a very blunt tool to try to bring down inflation.

Ms Bullock: Yes, it’s a blunt tool.

Senator ROBERTS: Thank you.

Interest rates are a blunt and lagging tool.

Steals peoples money and gives it to the banks.

A much better way would be to add 1% to super from wages, takes money out of economy immediately and it remains with the person released slowly at retirement.

Can also be reduced by % very quickly.

Increased interest rates are inflationary by increasing rents and prices of goods to maintain profits.

Inflation is taxation without legislation

I’m beginning to understand inflation a lot better now thanks.. You “create” money to increase spending then use a blunt tool to force people to give it to the banks.

Thank you for your persistence to overcome corruption, greed and self-centredness