The BRICS member states are abandoning the United States’ dollar and other nations are seeking to join the BRICS bloc, which accounts for 25% of world trade and is expected to grow to 50% by 2030. The US dollar is now just 58% of all world trade. As the world moves away from the US dollar its value may fall.

Our Reserve Bank holds AU$35 billion in foreign reserves and half of that is in US treasuries securities. I asked the Governor whether the RBA had modeled the probability of that fall on Australia’s US holdings and whether they intended to invest in more US treasuries. The governor expects Australia’s economy to grow and foreign holdings to increase — as part of risk management however they are looking at other currency markets in line with the RBA’s key bench marks, but without speculating on any future currency fluctuations.

The BRICS group of major emerging economies — Brazil, Russia, India, China (the four founding members of the bloc) and South Africa is holding its 15th heads of state and government summit in Johannesburg on 22nd August. Founded as an informal club in 2009, it was initially created as a platform to challenge a world order dominated by the US and its allies with a focus on economic cooperation and increasing multilateral trade and development. As many as 23 countries have now formally applied to join the group and many more are said to be interested.

With more countries investing in and accumulating greater gold reserves and widespread reports that the BRICS alliance is working on creating a new gold-backed trading currency, I asked the Governor if Australia is planning to increase our gold reserves.

The answer was no. “We’ve got our gold reserves and we haven’t bought and sold for a long time, and we have no intention of changing that.”

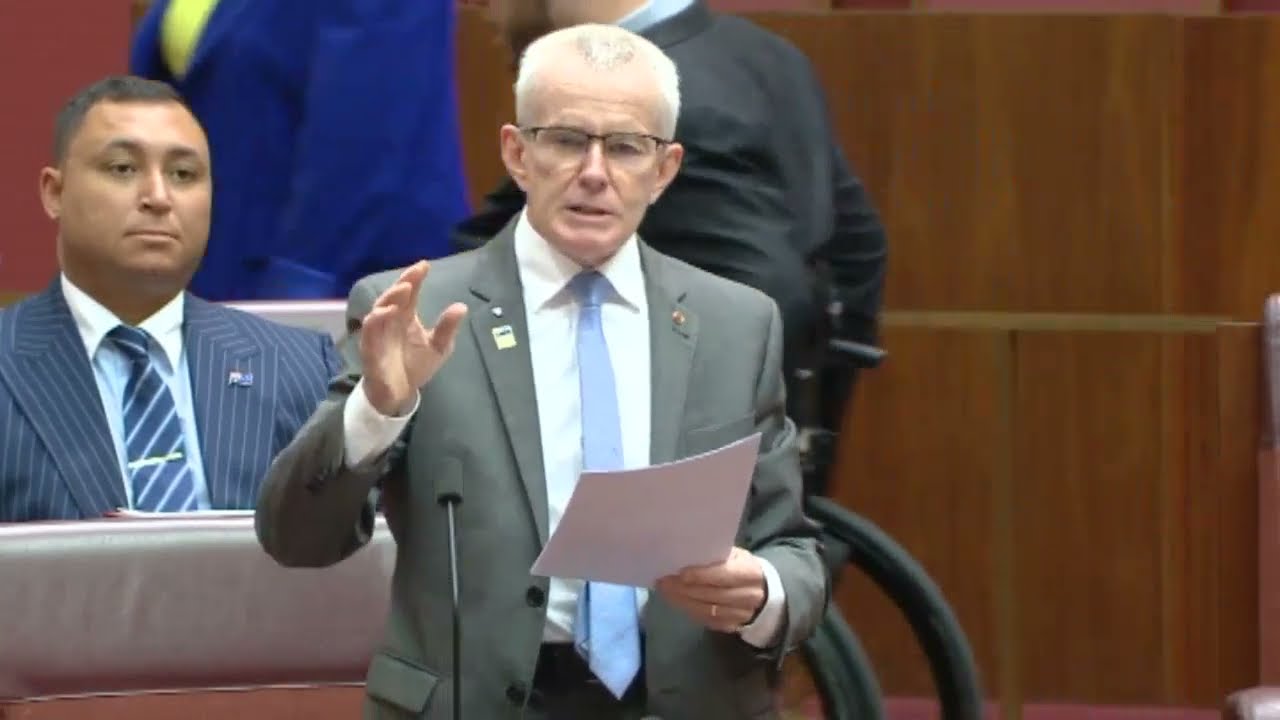

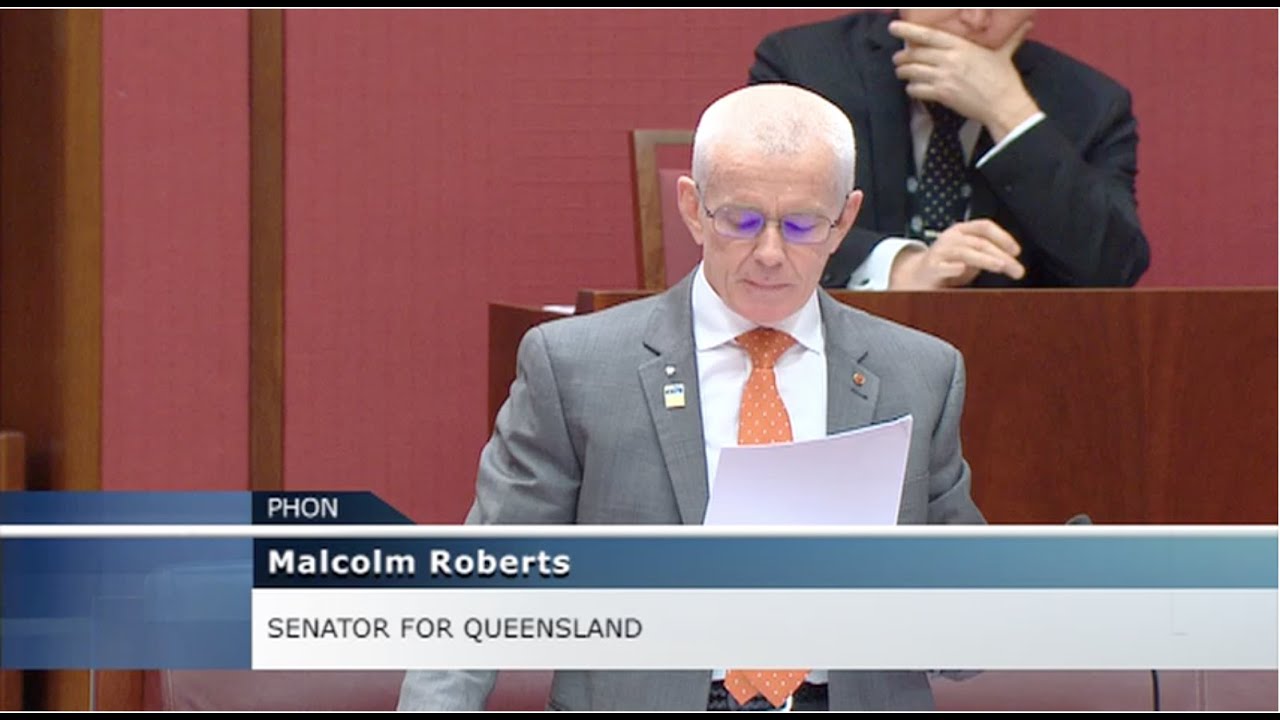

Transcript

Senator Roberts: I have a question about the Reserve Bank’s reserves. Let me get to it by giving some background. At the BRICS meeting in Cape Town on 2 and 3 June, 13 nations will formally apply to join BRICS, which is currently Brazil, Russia, India, China, South Africa—and Saudi Arabia, with an each-way bet. Candidate nations include Mexico, Argentina, the United Arab Emirates, Egypt, Indonesia and Iran. BRICS is now the world’s largest trading bloc, accounting for 25 per cent of world trade which is expected to grow to 50 per cent by 2030. And it’s big in oil.

BRICS member states are abandoning the US dollar in favour of using their own currency or the Chinese renminbi in an environment where other countries, including Australia, are doing the same thing. Pakistan is now buying Russian oil and renminbi. The US dollar is now denominating just 58 per cent of all world trade. The United States has printed $10 trillion over the last seven years, doubling their M2 money supply. That increase has been absorbed in part by an increase in international trade. As the world moves away from the US dollar the value of the US dollar may fall. The Reserve Bank holds United States treasuries and dollars. Have you modelled the effect on your balance sheet from that probable fall in the value of US holdings.

Mr Lowe: Not as a result of these other global changes you’ve talked about. We spend a lot of time and part of our risk management processes looking at volatility in currencies, because currencies move around all the time, don’t they? That affects the value of those assets on our balance sheet, so we model that from a risk-management perspective. Despite the developments you’re talking about, most countries still hold the bulk of their foreign reserves in US dollars. There’s diversification going on, which is good, but the US dollar is going to remain the dominant currency for some time.

Senator Roberts: What is the value of Reserve Bank holdings of US dollar and US treasuries in Australian dollars?

Mr Lowe: Our total foreign reserves at the moment I think are the equivalent of U$35 billion. What’s the share, Brad?

Dr Jones: I think it’s 55 per cent.

Mr Lowe: Roughly half of that $35 billion is allocated to US dollars, and then we have holdings of yen, Korean won, euros and rmb.

Senator Roberts: What about treasuries?

Mr Lowe: When we hold US dollars we invest it in US Treasury securities. We don’t invest in bank deposits or any other securities. We invest in US government securities.

Senator Roberts: What’s the reverse holding of Australian government currency and bonds held by the US government or their agencies?

Mr Lowe: We don’t have data on that.

Senator Roberts: Could you get that on notice?

Mr Lowe: No.

Senator Roberts: You don’t have it?

Mr Lowe: We don’t have data on specific holdings of other countries.

Dr Jones: If I understood your question correctly, Senator, the US holds euros and yen, from recollection, but not in large quantities.

Senator Roberts: While that arrangement helps with international stability across holdings, it is a method for backdoor quantitative easing. Does the Reserve Bank expect to increase your holding of US treasuries in the next 12 months?

Mr Lowe: We’ve just done an exercise where we were looking at how much of our balance sheet should be held in foreign assets. We said we’ve got $35 billion at the moment. As the size of the economy grows you would expect that to gradually increase. But, no, nothing dramatic. As the economy grows and the nominal value of the Australian economy gets bigger, then you would expect a bigger portfolio in US dollars and foreign currency.

Senator Roberts: The Reserve Bank has a mission to anticipate movements in major trading partners and in world markets. As it affects your provisioning and portfolio, does the Reserve Bank anticipate being affected by any out of the ordinary moves in financial markets in connection with the US economy or the US dollar over forward estimates?

Mr Lowe: We’ve recently been focused on the US debt limit issues in the US. If an agreement had not been reached there, that would have had implications for currency markets and economies around the world. So that’s one thing that we’ve looked at carefully. It looks like that has been resolved, thankfully. And, just as part of our general risk management exercise, we’re looking at developments in other economies and their implications for currency markets in own economy.

Dr Jones: As a general rule though, the way the bank has operated its reserves has changed quite a bit over the last, say, 25 years, and now the bank effectively sets key benchmarks and sticks to them. There are not big discretionary decisions going on every day. There’s wild speculation going on at the Reserve Bank, I can assure you, about the future value of exchange rates.

Senator Roberts: I wasn’t implying that. Worldwide purchases of US treasuries by central banks has fallen $600 billion in 2022 as compared to a baseline year of 2013. That’s just arbitrary—2013. Purchases of gold have increased $300 billion. So something is going on that Australia would be prudent to hedge against. Is the Reserve Bank increasing its gold reserves as an each way bet against BRICS introducing a gold brick currency of some form?

Mr Lowe: No, we’re not. We’ve got our gold reserves. We haven’t bought and sold for a long time and we have no intention of changing that at the moment.

Senator Roberts: Thank you, Governor.

Thank you Senator Malcolm Roberts

Disappointed to hear that they have no intention of increasing gold reserves.

So, what protects Australians from the market volatility?

I would have liked to have heard why they chose to not increase.

Australia has large deposits of gold still in the ground.