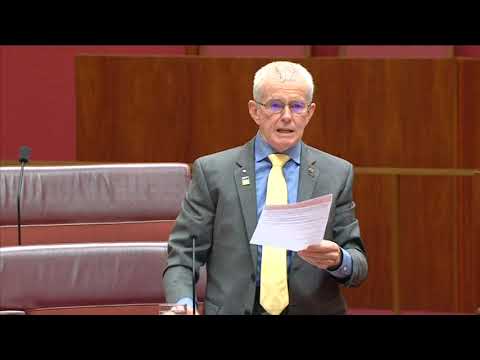

Transcript

Thank you, Mr President.

As a servant to the people of Queensland and Australia I proudly ask for the Senate’s support for the Banking Amendment Deposits Bill 2020.

Commonly called the NO bail-in bill.

Our purpose is to keep people’s money SAFE.

And to keep the banking system safe.

Let me first explain what is a bail-out and then a bail-in.

Bail-out’s have been used during financial crises when banks get into trouble and are a lifeline of money from taxpayers to banks to keep banks afloat. Govts act as a conduit from taxpayers to the corporate banks, even when the banks got into trouble due to their own greed or stupidity.

In times of profit banks are capitalists and in crises banks are socialist.

International Monetary Fund and G20 rules now though prevent taxpayers’ money being used to save a bank.

Instead requiring that rescue funds must come from shareholders and from depositors. A Bail-in.

Literally banks steal the money in retail deposit accounts and use that to save themselves. In exchange depositors get shares in the bank.

The shares are then suspended from trading – because the banks’ shares are worthless pieces of paper and will remain so for years.

‘Retail deposit accounts’ are the bank accounts of everyday Australians and small and medium-sized businesses.

This is money taken from these accounts, which people need to pay bills, buy stock, pay the rent and pay staff.

Gone.

This is money a couple is saving to buy their first home.

Gone.

This is money retirees cashed out of superannuation and is needed to live on, to buy food and clothing and pay bills.

Gone.

Gone. Overnight.

Reserve Bank figures show that 1 trillion dollars is available to be taken in a bail-in.

That’s what the Liberal, Nationals and Labor parties defend when opposing my bill.

Next, I’ll share a letter from a constituent, Peter Thompson, last week:

Quote: “As a self-funded retiree I shouldn’t be lying awake at night worrying how to safeguard my deposits from “bail in” by predatory and profligate banks, however I am!”

“I have Greek friends who lost most of their saving in the Greek bank bail in.”

“I don’t trust APRA nor the Treasury to protect my interests and certainly don’t trust any bank. We need a people’s bank… now.”

“What can I do to protect my bank deposits?”

Peter continues: “Withdraw cash, which by design is getting harder and harder to do, and take the risk it will be stolen by more obvious thieves?”

“One can’t buy land or property with the Australian real estate market in radical downturn, I want my deposits in a bank.”

“Your Banking Amendment (Deposits) Bill is a vote winner. It will give Australians, many of whom have no idea of what “bail in” entails, an opportunity to understand and take action to protect their savings and create confidence in the system. “

Thank you, Peter. Creating confidence is exactly why I have proposed this bill.

The public understands that the govt’s Cash Ban bill is designed to force everyday Australians to keep all their money in the banking system to make a bail-in much more effective.

Labor, Liberals and Nationals passed the Cash Ban bill through the House of Reps and are now terrified of the public and backbench backlash if it enters our senate.

The public understands our real estate prices are the third highest in the world.

The public understands that the govt’s COVID restrictions are destroying small and medium business and the ability of those business owners and their staff to service their mortgage, loans and credit card debt.

In fact, there is a sleight of hand going on here. A handful of large retail businesses, telcos and internet-based companies are doing better than ever.

While hundreds of thousands of small and medium businesses are doing much, much worse.

The effect on the economy of the govt’s COVID restrictions is much worse than the headline figures.

And yet State Governments recently doubled down with more lockdowns, more restrictions, more destruction of wealth, and more unemployment amongst small and medium businesses.

So the public are responding by removing cash from the banking system at an alarming rate – $20 billion in notes have gone missing in calendar 2020.

Cash is being stashed under beds.

My Bill is an opportunity to restore confidence in the banking sector.

It’s an opportunity to attract deposits from other countries where bank deposits are less secure than ours.

We could be a safe haven for legal investment in our banking sector – money that isn’t coming, for once, from the taxpayer.

Why shut that down and make banks even more reliant on the Government for funding?

What a missed opportunity that will be for our banks and for their customers.

The Liberal, National and Labor Parties now have a chance to stand up for everyday Australians.

To protect bank deposits from being bailed in.

The response from these tired old parties? Denial.

We’re told that this bill is not necessary. We’re told that the law does not allow for a bail-in.

I ask all Australians to listen more closely. Listen for their proof.

There is none.

No legal opinion, nothing but bland assurances from self-interested public servants hoping that constant repetition will fool the public.

Here’s MY argument. The Crisis Resolution Powers and Other Measures Act 2018, that was passed in the dead of night, with just 7 Senators present, uses weasel words to hide the reality.

The wording does allow for the banking regulator – APRA – to instruct the banks to bail-in retail deposit accounts.

The protections that the tired old parties rely on for the supposed opposite case are contained, not in the Crisis Resolution Powers Act, but in the Banking Act.

Their argument is a nonsense because the emergency provisions powers in the Crisis Resolution Powers Act over-ride the everyday protections in the Banking Act.

That’s why the govt has an emergency powers act. To provide extra powers in an emergency.

This is not just my opinion. It’s the International Monetary Fund’s opinion. Quote:

“The new ‘catch-all’ directions powers in the 2018 Financial Sector Legislation Amendment (Crisis Resolution Powers and Other Measures) Bill provide APRA with the flexibility to make directions to the banks that are not contemplated by the other kinds of general directions listed in the Banking Act.”

“[APRA’s] Direction powers are a key element in the resolution process for a distressed bank. APRA could order a bank to recapitalize…using the funds of unsecured creditors”

The IMF goes on to define ‘unsecured creditors’ as shareholders and retail depositors.

Liberal MP Tim Wilson, Chair of the House Standing Committee on Economics has admitted the Crisis Resolution Powers Act does allow for a bail-in.

Liberal Senator Amanda Stoker in a letter to a constituent admitted that legislation allows for a bail-in.

Yet their party bosses say the complete opposite.

Why would they do that?

Well, the answer is yet again because of our international obligations. The G20 and the IMF have dictated that taxpayers’ money can’t be used to rescue a bank.

The tired old parties know that letting unelected bureaucrats in New York and Brussels tell Australians what to do in a crisis does not pass the pub test.

So the tired old parties hide the facts and contradict reality using weasel words.

It‘s instructional to note that New Zealand’s response to the same IMF and G20 instruction is to do the opposite. The Kiwis dutifully wrote their bail-in laws and made them honest and transparent. If a bank fails the bank closes, pays off it’s debts using depositor funds and then re-opens the next day. Depositors can access what remains of their money. If there is any.

I’m not suggesting the New Zealand model is better. More honest yes, better no.

There’s a simple solution for bank failures.

When a bank fails, the Government could issue bonds. Currently we’re offering just 1% interest on bonds, so it’s not a costly option. We then use that money to buy new shares in the failing bank. That injects enough capital for the bank to survive.

Then vest those shares with the Future Fund, who pay that small interest payment on the bonds.

In a few years those shares will be worth money again and the Future Fund can sell them back into the market in an orderly fashion.

In this simple, ‘One Nation bank survival plan’, taxpayers’ money would not be used to save the bank, so our IMF and G20 masters should be pleased.

Nobody in our process loses money. Depositors keep their cash; banks keep trading, mum and dad shareholders retain the value of their shares over the medium term.

What’s the Labor and LNP track record on corporate bail-outs?

Both gave foreign car companies billions and then watched them shut up shop as soon as the money tap was turned off.

If we’d been asking for shares for that money, we would now own the car companies. We would still have a car manufacturing sector, we would still have all those wonderful breadwinner jobs for workers.

Prime Minister Gillard gave ABC Child Care $120m. Not in exchange for shares, it was another gift from taxpayers.

If we’d asked for shares in ABC Childcare in return for the bail-out those shares would be worth $250 million today.

Our response to a bank failure should not be “go and steal it from customers.“

Our response should be to use capitalism to fix crony-capitalism.

Labor are having a lot to say about their Financial Claims Scheme Guarantee (FCS).

The Financial Claims Scheme Guarantee will advance up to $20 billion per bank, to protect deposits if a bank fails.

Let’s take a closer look at the Financial Claims Scheme Guarantee.

The vast majority of the $1 trillion in retail deposit accounts is held by the big 4 banks. $20 billion times 4 though is only $80 billion. The Financial Claims Scheme Guarantee will save less than 10% of bank deposits!!!!

The Financial Claims Scheme Guarantee is not active and is not funded. There’s no money sitting there ready to go. Not one cent.

Should a bank fail, the Treasurer must issue a notice to activate the scheme. Yet, the Labor scheme uses taxpayer’s money to bail-out banks so the Treasurer will not issue the notice because the notice would breach IMF orders.

In the unlikely event of the Financial Claims Scheme Guarantee being activated, there’s a second problem that Labor never discusses: once the Financial Claims Scheme Guarantee is activated APRA must liquidate the bank to get taxpayers’ money back.

How much does anyone think will be available to retail depositors if the bank is liquidated? And how long will customers have to wait to get their money back from the liquidator?

The Financial Claims Scheme Guarantee is worse than a con job. It will make things worse.

Earlier I said that once a bank fails, whether that failure is public or only known to the regulator, the Financial Claims Scheme Guarantee scheme can be activated if the Treasurer so chooses.

The whole point of a bail-in is to prevent a bank failing.

This means the bail-in can only come first. And will come first. Then if the bail-in doesn’t work the Financial Claims Scheme Guarantee triggers, 10% of bank deposits are saved and the bank is liquidated.

This is what Liberals, Nationals and Labor are relying on to falsely tell everyday Australians ‘our money is safe?’ Yet the reality is that it’s not safe.

Following the dictates of unelected globalist masters is more important to them than looking out for the interests of everyday Australians.

The Government has advanced a criticism of my bill, that the definition of ‘retail deposit account’ introduces a different definition than is contained elsewhere in the Banking Act.

This argument fails because the only place the phrase ‘retail deposit account’ appears in the Banking Act is in my amendment. We did that deliberately so as to not interfere with the rest of the act.

Criticism dismissed.

In concluding Mr President, at no time has the Government, the Treasurer or APRA actually said they will not order a bail-in. These govt agencies duck the question and say “APRA doesn’t have the power”.

Well Mr President my bill clears that up. My bill adds one clause to the Banking Act that simply says APRA does not have the power to order a bail-in.

No other powers are affected.

Passing my bill ensures everyone will read it the same way.

Let Australians know that our money is safe in a bank. Let Australians know that there’s no need to stuff cash under the bed.

Even the Australian Bankers Association in its submission said if there is any confusion about what the law actually says then consider passing my bill.

What a great idea.

Let’s pass this bill, to keep people’s money safe.

Fantastic speech……. but is Labor a traitor to the blue-collar worker even so after this obvious dilemma for them now?