De-banking is the process of banks closing accounts for businesses or individuals. All the big banks are now de-banking clients and claiming that this is for Anti Money Laundering reasons, but it is just not true. At our Senate Estimates questions, APRA agreed they had authority in this area and also agreed they were doing nothing about this scandal.

The companies being de-banked are bullion dealers, bitcoin exchanges and cash handling companies working to keep ATMs in clubs and pubs full and so on. All of the companies that have been de-banked that my office has looked at are legitimate, long-established companies that are following the law.

The only explanation for de-banking is this – banks are shutting down their competitors. This is an abuse of their market power that will prevent competition in banking and reduce freedoms Australians enjoy as to the choice of what to do with their own money. This is bank greed and the supposed-regulator the Australian Prudential Regulation Authority are facilitating this by looking the other way.

The Cash Ban Bill produced by Treasury works with the banks by de-banking their rival businesses and then preventing those businesses to move over to cash payments. This effectively puts these banking rivals out of business.

Transcript

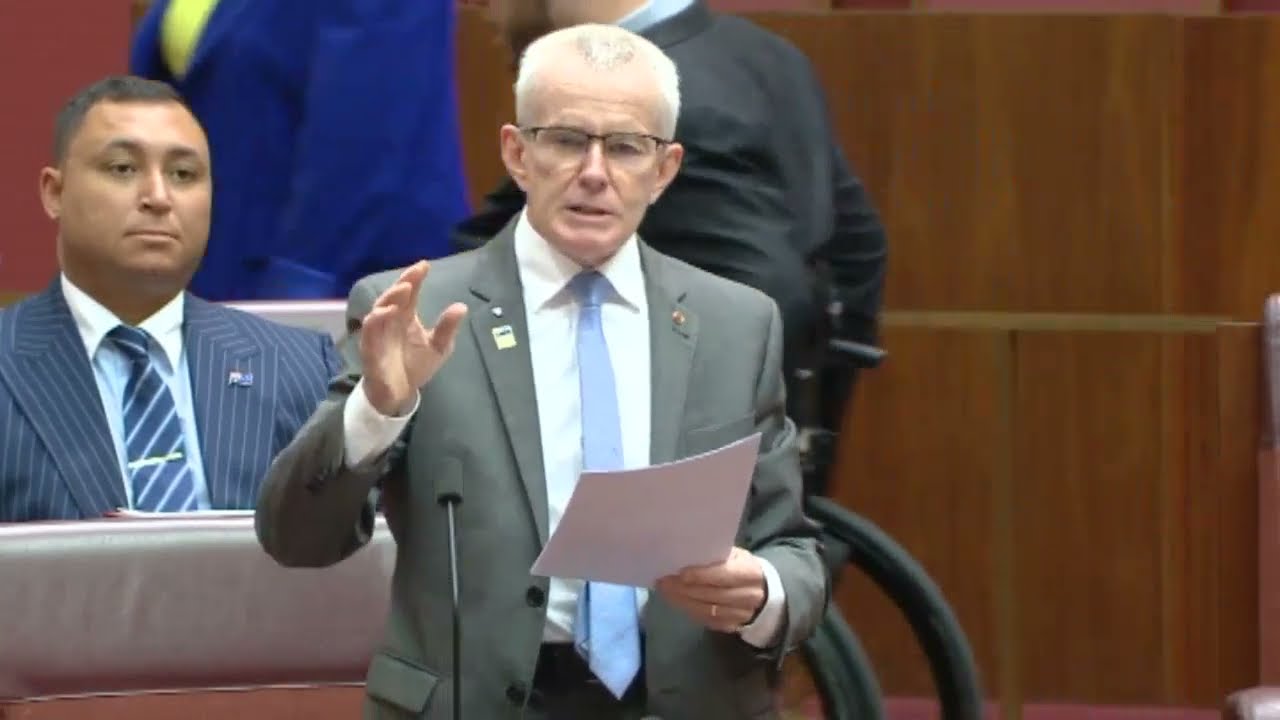

Senator ROBERTS: Moving onto the practice known as debanking, is the regulation of debanking practised by the banks your responsibility?

Mr Byres: I don’t know that I can talk about a regulation for debanking. The concern is that various customers no longer get banking services. It’s certainly not a primary issue for APRA. We understand the issue exists. In many cases, it relates to banks being able to comply with anti-money-laundering and counterterrorist-financing regulations.

Senator ROBERTS: That’s where I’d go. Commander Security is an Australian cash security company. It transits cash, and a large part of that is refilling third-party ATMs. So it’s a competitor to the banking cartel. Commander Security is fully AUSTRAC compliant and operates its accounts lawfully. On 14 October 2020, it received a notice from Westpac cancelling Commander Security’s banking accounts effective from 26 October. It has been refused accounts at other banks. Where is the protection of interests of depositors in this process?

Mr Byres: The depositors of the banks themselves are protected. I’m not aware of the specific case that you’re referring to. We’re happy to look at that.

Senator ROBERTS: Let’s look at another one then. Melbourne Gold Exchange sell bullion to retail investors. It is also AUSTRAC compliant and operates legally. It was debanked by Westpac, then the Commonwealth, then the NAB and now cannot get an account anywhere. Would you categorise bullion as a rival store of wealth to cash in the bank?

Mr Byres: No, I wouldn’t actually. I think cash in the bank has a very stable value and bullion does not. But that’s a discussion about investment rather than safety.

Senator ROBERTS: Bullion’s not stable? Okay. The point of this question is simple: banks are debanking businesses that they have decided are an unacceptable risk. When my office looks at these businesses, they are bullion dealers, non-bank companies providing rival services to the banks, like Commander Security, and bitcoin exchanges. APRA appear to be turning a blind eye to Australian banks debanking their rivals. Can you explain that?

Mr Byres: I don’t think we’re turning a blind eye to it. We understand the issues there, but banks are making decisions based on their risk profile as to whether they want to take on the risk associated with some of these customers. Clearly what we have seen in recent times is that the penalties for getting it wrong are significant. That’s not to condone the banks but to simply make the point that they’re taking it very seriously.

Senator ROBERTS: When the Melbourne bullion company was debanked, Westpac debanked not only the accounts but also the private accounts of the owners and the private accounts of their employees. APRA is responsible for protecting the financial interests of depositors. Does APRA consider this acceptable behaviour?

Mr Byres: Just to be clear, our obligation to depositors is not a consumer protection obligation, it’s making sure that people get 100c in their dollar—

Senator ROBERTS: I think you’re also responsible for making sure that there’s adequate competition.

Mr Byres: We have to be mindful for competition, but we don’t have a mandate to promote or establish competition. We have to deliver safety and soundness having regard to a range of other factors: competition, efficiency, ability and competitive neutrality. But we’re not primarily a competition regulator.