During Question Time, Finance Minister Katy Gallagher twice failed to rule out adding a tax to clothing.

This tax will be passed on to you and I at the checkout, making clothing more expensive and adding to the cost of living. The excuse for this tax is to reduce climate change by reducing the amount of clothing being manufactured. The wealthy wont reduce their purchases for the sake of a tax, yet everyday Australians will have no choice.

This exchange shows the Albanese Government really is considering taxing the shirt on your back, so you buy fewer clothes. Welcome to life under a Labor/Greens/WEF government.

Transcript

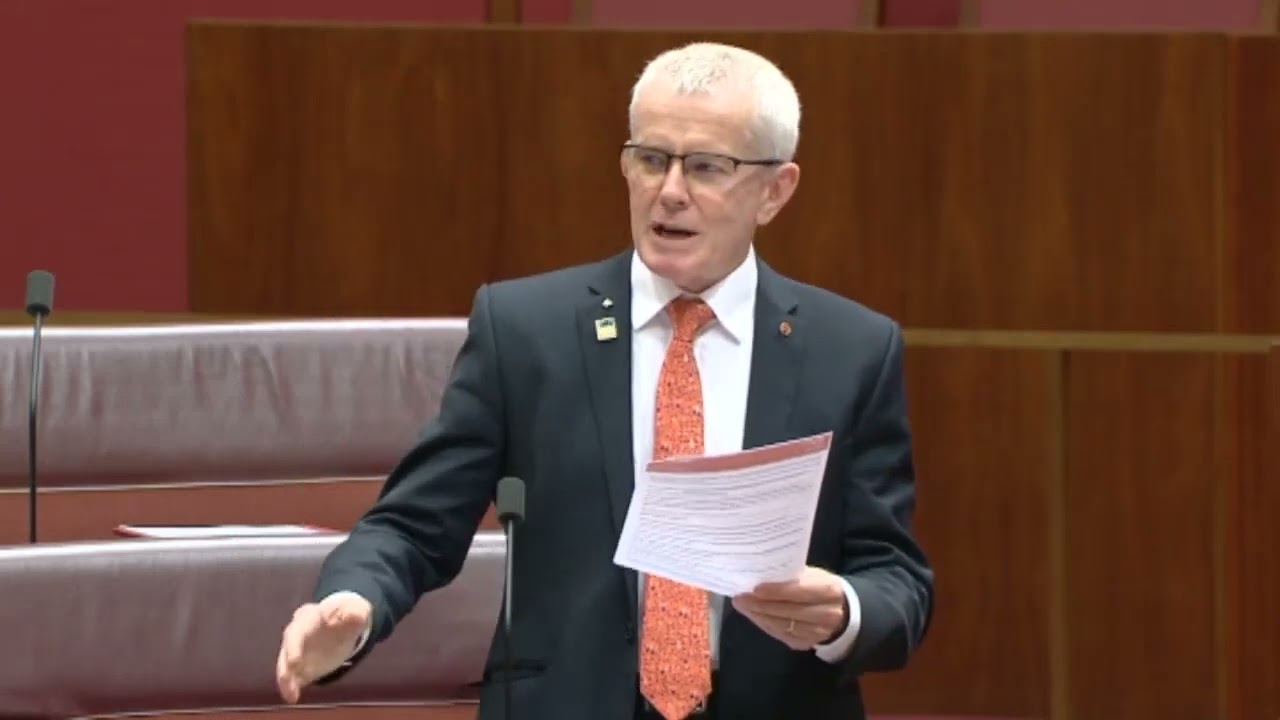

Senator ROBERTS: My question is to the minister representing the Minister for the Environment and Water, Senator Gallagher. Last week the Minister for the Environment and Water, Tania Plibersek MP, stated that Australians were throwing out too many items of clothing, and manufacturers should sign up to a government-backed scheme called Seamless to recycle and not dump used clothes. Clothing can and should be recycled into new clothing and other fibre products. One Australian company operates an upcycling scheme that has dozens of manufacturers, trade linen suppliers, recycling companies and retailers as members, and has taken 100 tonnes of clothing out of landfill. Minister, why is the government reinventing the wheel, creating its own favoured solution and imposing that instead of working with the industry to help them upscale their existing solution?

Senator GALLAGHER (Australian Capital Territory—Minister for the Public Service, Minister for Finance, Minister for Women, Manager of Government Business in the Senate and Vice-President of the Executive Council): I thank Senator Roberts for the question. From what I’ve seen from the minister and the work that she has been doing in space, she has been working with industry and relevant businesses on the development of this policy. That has been critical to the work that she has been doing and it has certainly been under way for some time. I know there was talk before there was a summit and there was talk of a voluntary code, but it is an important part of ensuring that we are protecting the environment from the amount of waste that is going into landfill—and a big contributor of that is clothing. I don’t know, maybe I have misunderstood your question, Senator Roberts, but while there are manufacturers and industries in place that are already doing this, this is about building on that and making it more across-the-board, particularly for those that aren’t doing that, to make sure we are lifting our game in relation to recycling, and preventing the huge amount of clothing material going into landfill. If there are manufacturers or businesses that you think are feeling out of the loop of that consultation I’m sure the Minister for the Environment and Water would be happy to reach out.

The PRESIDENT: Senator Roberts, a first supplementary question?

Senator ROBERTS: Councils do not currently include clothing on the list of things people can put into a yellow bin. Most suggest giving used clothes to charity shops, very little of which can be resold. Most of that ends up in landfill at the charity shop’s expense. Isn’t the first step here sorting out the system for recycling and processing, then working with councils and retailers to encourage recycling through yellow bins? Is your government putting the cart before the horse?

Senator GALLAGHER: I don’t accept that, Senator Roberts. Where we can, we do work with councils and we work with businesses—we’ll work with anybody who wants to help protect the environment and reduce the amount of waste going to landfill. From my reading—and I was not here last week—of the work that Minister Plibersek was doing, it was about encouraging the voluntary cooperation or involvement of businesses in Seamless, in that program, to build it from there. So I would think, yes, you have to work with all of those people, including the councils that run the recycling facilities, whether it be the tips or whether it be what is called the Green Shed here. People donate to Vinnies. There are clothing bins. There are all of those options. Many of those are run by local government. But the Commonwealth government should provide a leadership role and provide that stewardship, where we can, and work together with everybody involved.

The PRESIDENT: Senator Roberts, a second supplementary?

Senator ROBERTS: Minister Plibersek threatened that if the industry did not accept the government’s superfluous Seamless then a 4 cent waste levy should be imposed on clothing manufacturers. This proposal will increase the cost of clothing at the checkouts. Minister, will you, right now, rule out taxing clothing?

Senator GALLAGHER: Minister Plibersek has been working with the industry to reduce the amount of waste. Clothes are cheaper than they have ever been—this is part of the problem. Anyone with teenagers or anyone who goes on some of these websites knows that you can replace your whole wardrobe, very cost-efficiently, because of the nature of people’s buying habits and the ability to get clothes from overseas. We are seeing that the average Australian sends almost 10 kilos of clothing waste to landfill every year. So it is a big problem, and it’s a problem that we need to work across industry to fix.

The PRESIDENT: Minister, please resume your seat. Senator Roberts?

Senator ROBERTS: A point of order on relevance: I asked, ‘Will the minister now rule out taxing clothing?’

The PRESIDENT: The minister is being relevant to your question, Senator Roberts.

Senator GALLAGHER: I am explaining what the government is doing. You might want to take it somewhere else, which we have no plans to do. We are talking about what we are doing now with Seamless, which is: working with industry to reduce the amount of clothing going to landfill. And we will work with anybody who wants to work with us on that.

Following Question Time, I moved to take note of the Minister’s response to my questions.

When did it become appropriate for the government to decide how much clothing you own? Minister Tania Plibersek is repeating World Economic Forum rhetoric designed to widen the gulf between the haves and the have nots. It’s terrifying that Minister Plibersek should recycle WEF talking points to the Australian public.

The real failure however is that many people aren’t aware that clothes can be recycled. Councils and retail stores don’t offer recycling options, and although the fashion industry has started recycling facilities in Sydney and Melbourne, more is needed.

Instead of taxing clothing, how about working with the industry to expand capability and encourage the clothing industry to tag items for recycling instead of throwing them out. The government could do with ignoring the WEF and its CCP-style rules and instead think for itself on behalf of Australians not globalists. How about less stick and more common sense?

Transcript

I move:

That the Senate take note of the answer given by the Minister representing the Minister for the Environment and Water (Senator Gallagher) to a question without notice I asked today relating to the government’s proposed tax on clothing.

We are told the proposed tax on clothing is to encourage recycling. The proposal from the Minister for the Environment and Water was floated over the weekend. This was not some random thought bubble. The World Economic Forum and its acolytes have been saying for years that everyday citizens are buying too much clothing. Minister Plibersek repeated those World Economic Forum talking points in the same press conference. This begs the questions: What’s the correct amount of clothing a person can own? Who decides how much clothing we each get to own? Is the intent to remove colour and style options so that a few approved uniforms are all we need? Didn’t China try that already?

This proposal sits alongside the World Economic Forum policy that I spoke to last sitting, calling on people to wear clothing for a week and jeans for a month before washing them. It’s true that laundering clothing does wear it out. To get by with fewer items of clothing, one has to wash them less often. At least they thought this through.

It’s terrifying that a minister of the Crown would repeat World Economic Forum talking points designed to ensure that everyday Australians have less. The failure here, though, is this: the reason we throw out so much clothing is that Australians don’t know clothing can be recycled. Councils don’t have clothing on the lists of things you can put in a yellow bin. Retailers don’t have recycling bins in stores, and they don’t attach a tag to a garment saying, ‘You can recycle the product in a yellow bin.’ The industry already has recycling facilities in Sydney and Melbourne, which is a good start.

Here’s an idea: instead of taxing clothing to create a new recycling system, as the Labor Party is considering, how about working with the industry to expand capability and then encourage the public to recycle clothing instead of throwing it out? This government needs to use less stick and more commonsense. It needs to use less control and do more listening and consulting.

Question agreed to.

If Aussies don’t stand up together against this tiranny and evil government now and stop being so apathetic our freedom is doomed. All the politicians and medical people involved in pushing the deadly jabs on people and enforcement of illegal lockdowns should go to prison. Wake up Aussies

Labor, greens and teals and certain libs all need to be shown the door. Nothing but WEF IMF WHO UN globalists….. Serving the puppet masters not their country. Most useless and incapable government in history.

Why aren’t we taxing gas mining companies like other countries instead of basically paying them to take our gas overseas?!

Taxes are being thrown at us all with no recourse

ATO ‘s answer to taxing young ones trying to pay HECS each year has suddenly added interest onto each year from the time they graduated not as was originally stated when they began receiving higher wage the HECS tax would be taken each year to repay the debt.

Now even though paying this tax each year they emailed my daughter and others with another bill with more interest added When , after many calls she finally got thru to ATO to speak to someone they said it’s because of inflation and yes you have to pay The extra interest on previous years. Even tho she had worked 3 jobs at minimum wage just to pay rent before finally having work in the area she studied.

I’m sure many others have been upset that these changes were not disclosed to them in any communication from ATO or govt.

Also as many other home owners will notice this year my land tax doubled from the previous year here on the Gold Coast with no explanation

I find it offensive that they are charging people in units these exorbitant rates too, no wonder local councils are happily allowing higher & higher unit development to rake in more rates from one block of land while the residents have to scrimp & save to stay in their homes. A definite reason why there are so many homeless people with govt hitting all Australians in every direction. It’s disgusting! They are cashing in on the public to feather their own nests and we have to pay for them to have free rides doing whatever they like They travel at our expense and all the other perks & payments they allow themselves . This corruption is on every level and they use whatever reason they think is viable like climate, inflation, etc… people have to have a voice & know that the elections are not being rigged towards the 2major parties .. because they need to go Along with the so-called Greens as well.

You can’t go along with these Labor Liberals and not realise how corrupt their dealings are.

Taxes are being thrown at us all with no recourse

ATO ‘s answer to taxing young ones trying to pay HECS each year has suddenly added interest onto each year from the time they graduated not as was originally stated when they began receiving higher wage the HECS tax would be taken each year to repay the debt.

Now even though paying this tax each year they emailed my daughter and others with another bill with more interest added When , after many calls she finally got thru to ATO to speak to someone they said it’s because of inflation and yes you have to pay The extra interest on previous years. Even tho she had worked 3 jobs at minimum wage just to pay rent before finally having work in the area she studied.

I’m sure many others have been upset that these changes were not disclosed to them in any communication from ATO or govt.

Also as many other home owners will notice this year my land rates doubled from the previous year here on the Gold Coast with no explanation

I find it offensive that they are charging people in units these exorbitant rates too, no wonder local councils are happily allowing higher & higher unit development to rake in more rates from one block of land while the residents have to scrimp & save to stay in their homes.

A definite reason why there are so many homeless people with govt hitting all Australians in every direction. It’s disgusting! They are cashing in on the public to feather their own nests and we have to pay for them to have free rides doing whatever they like They travel at our expense and all the other perks & payments they allow themselves . This corruption is on every level and they use whatever reason they think is viable like climate, inflation, etc… people have to have a voice & know that the elections are not being rigged towards the 2major parties .. because they need to go Along with the so-called Greens as well.

You can’t go along with these Labor Liberals and not realise how corrupt their dealings are.

Everything government are doing is in lockstep, keep the masses poor. Force the people into buying EV cars, promote a meatless diet, make the cost of living unaffordable for everyone, get farmers off their land, what comes next? no private ownership of land ! a move to get us into smart cities, a digital currency so government know exactly what we’re spending our money on and can turn that currency off, Digital ID so they know what we’re looking at on the internet, its just one control measure after another until we are all living the Orwellian nightmare ( Agenda 21/30). No freedom what so ever for the people. We will eat the bugs and fake meat while owning nothing and be happy.

Laura

This is not the country I immigrated to 25 years ago. This socialistic, communistic, weak, corrupt government is completely under outside control and unable to get out of the grips of the wef, un, who …The homeless are living in tents, in vans, under trees in the park, under bridges, on the beach…is utterly heartbreaking and frightening that this country has disintegrated to this level. Taxes on everything from rates + government fees, insurance plus government fees,

rego plus government fees, property purchases plus government fees, property purchases AND sales plus government fees…car purchases plus government fees,……everything incurs extra funds for the government. This does not include the taxes we pay, the GST we pay, the card charges on everything we buy, the land tax if you dare to own more than one property, capitol gains tax if you are lucky enough to make a profit….And wait this is just the beginning there is a lot more to come…….

This is not the country I immigrated to 25 years ago. This socialistic, communistic, weak, corrupt government is completely under outside control and unable to get out of the grips of the wef, un, who …The homeless are living in tents, in vans, under trees in the park, under bridges, on the beach…is utterly heartbreaking and frightening that this country has disintegrated to this level. Taxes on everything from rates + government fees, insurance plus government fees,

rego plus government fees, property purchases plus government fees, property purchases AND sales plus government fees…car purchases plus government fees,……everything incurs extra funds for the government. This does not include the taxes we pay, the GST we pay, the card charges on everything we buy, the land tax if you dare to own more than one property, capitol gains tax if you are lucky enough to make a profit….And wait this is just the beginning there is a lot more to come……. THANK YOU TO ONE NATION AND MALCOLM ROBERTS for trying to to change our lives.

This is not the country I immigrated to 25 years ago. This socialistic, communistic, weak, corrupt government is completely under outside control and unable to get out of the grips of the wef, un, who …The homeless are living in tents, in vans, under trees in the park, under bridges, on the beach…is utterly heartbreaking and frightening that this country has disintegrated to this level. EXTRA Taxes on everything from rates, insurance, rego, property purchases, property sales, car purchases, ,……everything incurs extra funds for the government. This does not include the taxes we pay, the GST we pay, the card charges on everything we buy, the land tax if you dare to own more than one property, capitol gains tax if you are lucky enough to make a profit….And wait this is just the beginning there is a lot more to come……. THANK YOU TO ONE NATION AND MALCOLM ROBERTS for working so hard to to change our lives.